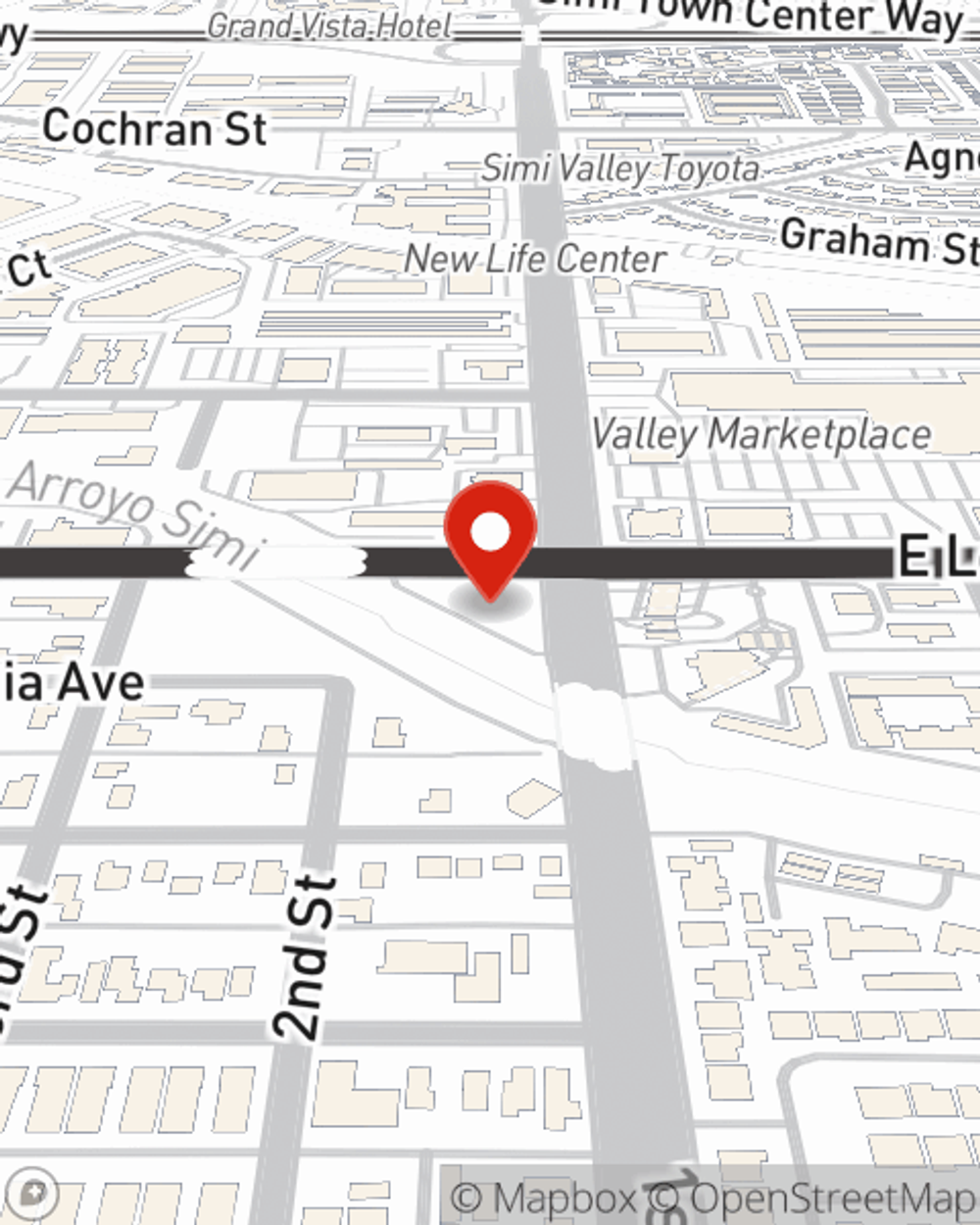

Business Insurance in and around Simi Valley

Looking for coverage for your business? Look no further than State Farm agent Eric Little!

Insure your business, intentionally

State Farm Understands Small Businesses.

Preparation is key for when a problem happens on your business's property like an employee getting hurt.

Looking for coverage for your business? Look no further than State Farm agent Eric Little!

Insure your business, intentionally

Keep Your Business Secure

With State Farm small business insurance, you can give yourself more protection! State Farm agent Eric Little is ready to help you handle the unexpected with dependable coverage for all your business insurance needs. Such personalized service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If the unexpected happens, Eric Little can help you file your claim. Keep your business protected and growing strong with State Farm!

Curious to research the specific options that may be right for you and your small business? Simply reach out to State Farm agent Eric Little today!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Eric Little

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.