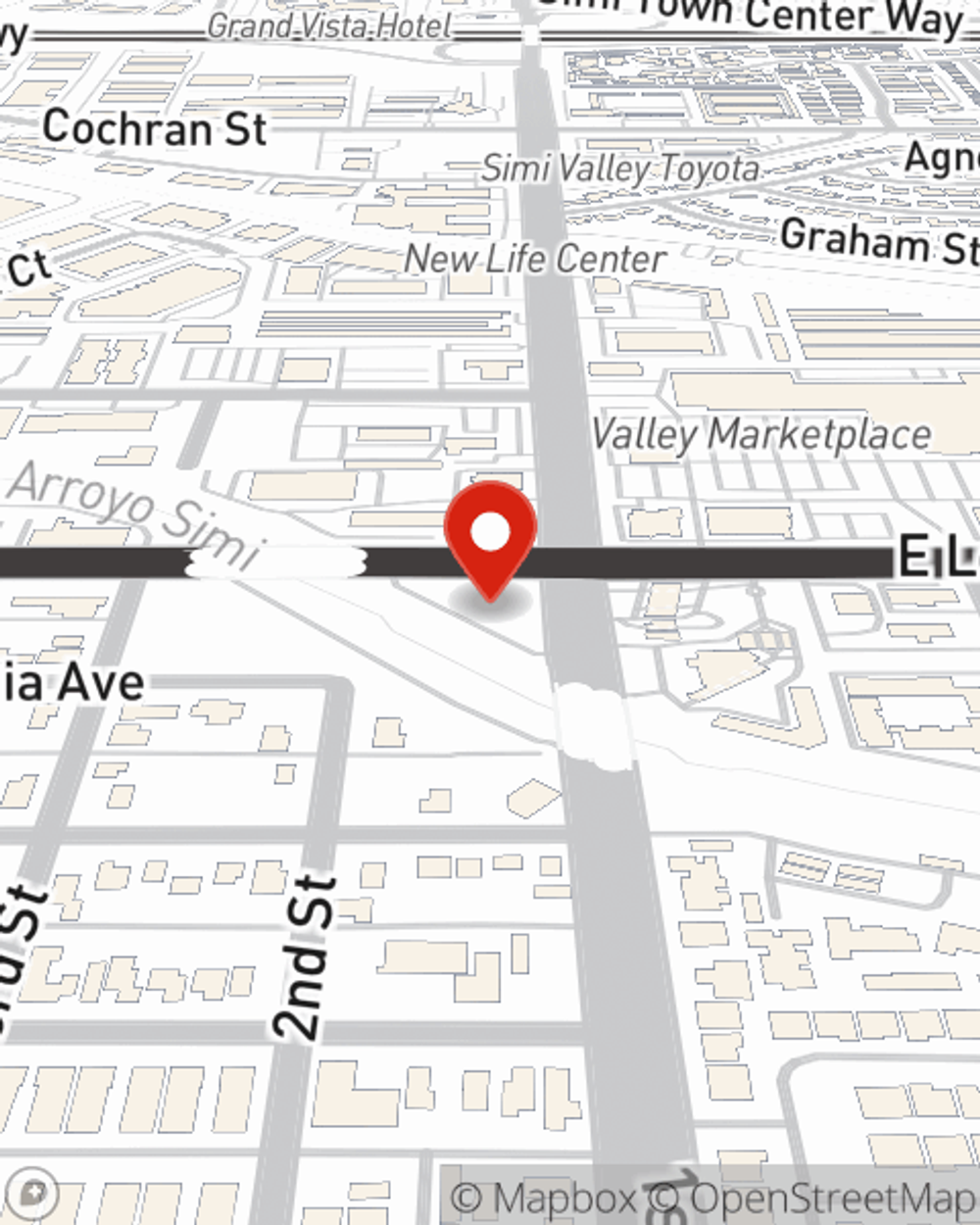

Renters Insurance in and around Simi Valley

Get renters insurance in Simi Valley

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

The place you call home is the cornerstone for everything you treasure. It’s where you build a life with family and friends. Home is truly where your heart is. That’s why, even if you live in a rented condo or property, you should have renters insurance—whether or not your landlord requires it. It's coverage for the things you do own, like your microwave and lamps... even your security blanket. You'll get that with renters insurance from State Farm. Agent Eric Little can roll out the welcome mat with the knowledge and wisdom to help you insure your precious valuables. Skilled care and service like this is what sets State Farm apart from the rest. When you're covered by State Farm, your rental can be home sweet home.

Get renters insurance in Simi Valley

Renting a home? Insure what you own.

There's No Place Like Home

It's likely that your landlord's insurance only covers the structure of the home or apartment you're renting. So, if you want to protect your valuables - such as a tablet, a couch or a TV - renters insurance is what you're looking for. State Farm agent Eric Little has the knowledge needed to help you evaluate your risks and insure your precious valuables.

Don’t let fears about protecting your personal belongings make you unsettled! Visit State Farm Agent Eric Little today, and find out how you can benefit from State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Eric at (805) 581-5460 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Eric Little

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.